Automate your business with

T3 Loan DSA CRM

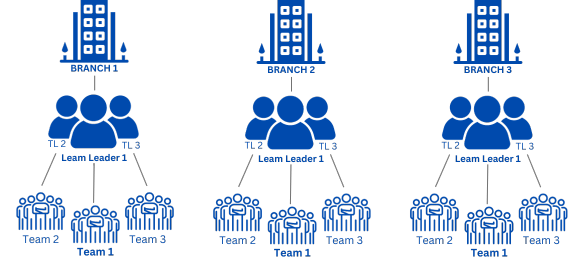

Manage All Branches Under One Roof

Manage All Branches Under One Roof

The T3 System significantly enhances the efficiency and effectiveness of Direct Selling Agents (DSAs) in the loan process. With its robust features, the system streamlines various stages, from lead management to application processing and follow-ups. Here’s how T3 contributes to the DSA procedure

T3 loan DSA CRM System helps marketing team to store the scattered data gathered via

T3 loan DSA CRM System helps marketing team

to store the scattered data

gathered via

The T3 DSA features an auto-dialer that automates phone calls, eliminating the need for manual dialing and enhancing efficiency.

DSAs can manage a lead database by recording contact information and categorizing leads based on interest or loan type, allowing them to prioritize follow-ups effectively.

T3 Loan DSA CRM equips salespeople with essential information, enabling them to work smarter and capitalize on every opportunity.

When a client expresses interest and accepts the company’s terms and conditions, the opportunity is classified as a lead.

DSAs can schedule follow-ups and maintain communication using scripts, email, and SMS until they receive interest or a request to cease contacts.

The T3 DSA automates phone

calls using auto-dialer

software, which eliminates

manual dialing.

DSAs maintain a lead database, recording contact info and categorizing leads by interest

or loan type to determine

follow-up priority.

DSAs schedule follow-ups, maintain communication with scripts, and use email and SMS until there's interest or a request not to be contacted.

T3 loan DSA CRM empower salespeople with information to sell smarter and never miss an important deal.

When Client starts showing interest & accepts company's terms & conditions, it turns into Lead

The T3 DSA automates phone

calls using auto-dialer

software, which eliminates

manual dialing.

DSAs maintain a lead database, recording contact info and categorizing leads by interest

or loan type to determine

follow-up priority.

DSAs schedule follow-ups, maintain communication with scripts, and use email and SMS until there's interest or a request not to be contacted.

T3 loan DSA CRM empower salespeople with information to sell smarter and never miss an important deal.

When Client starts showing interest & accepts company's terms & conditions, it turns into Lead

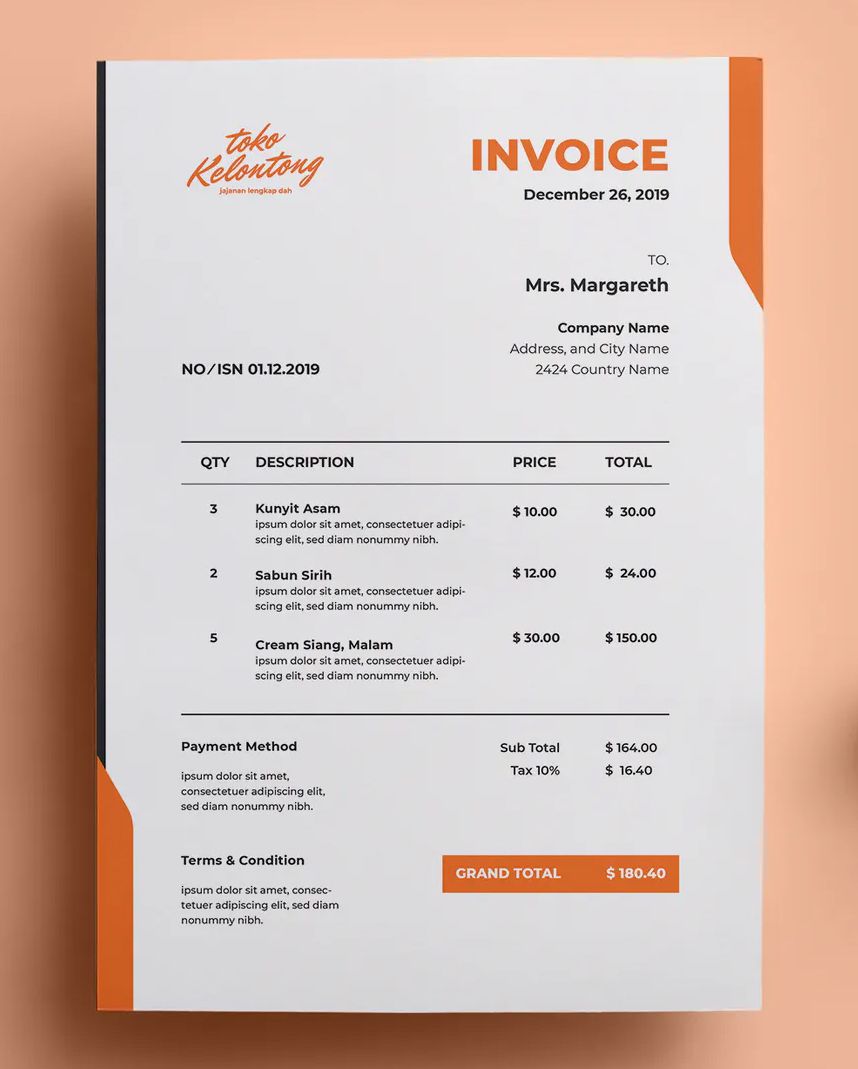

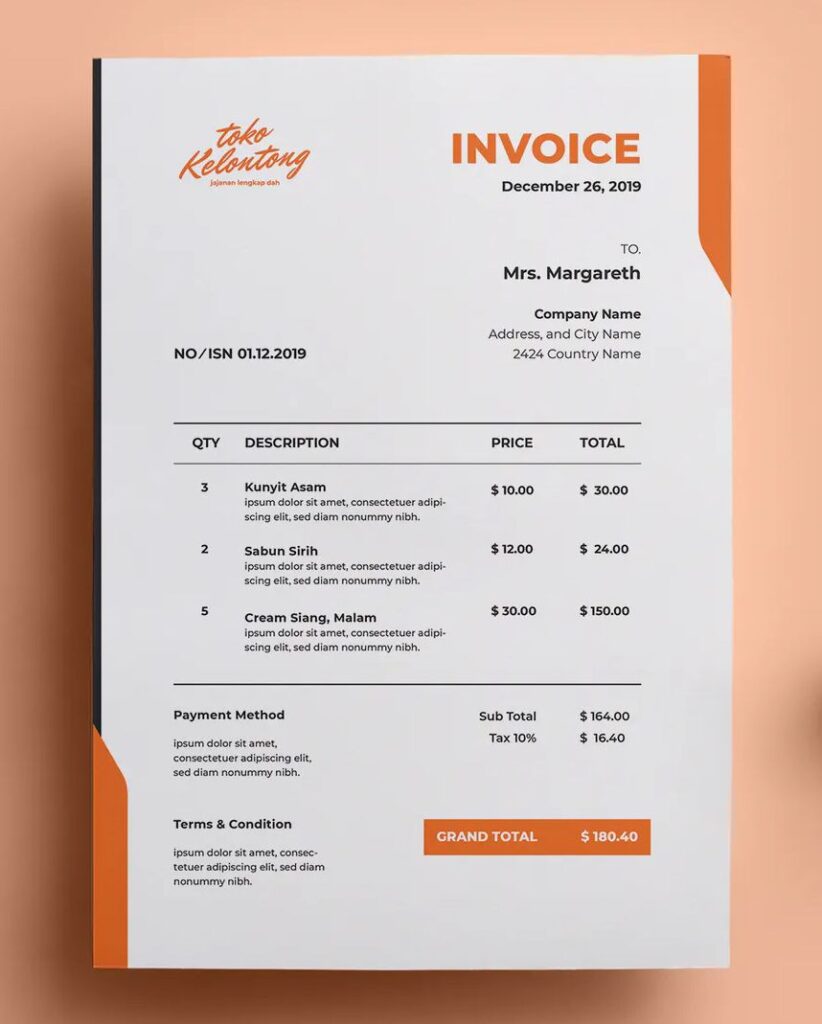

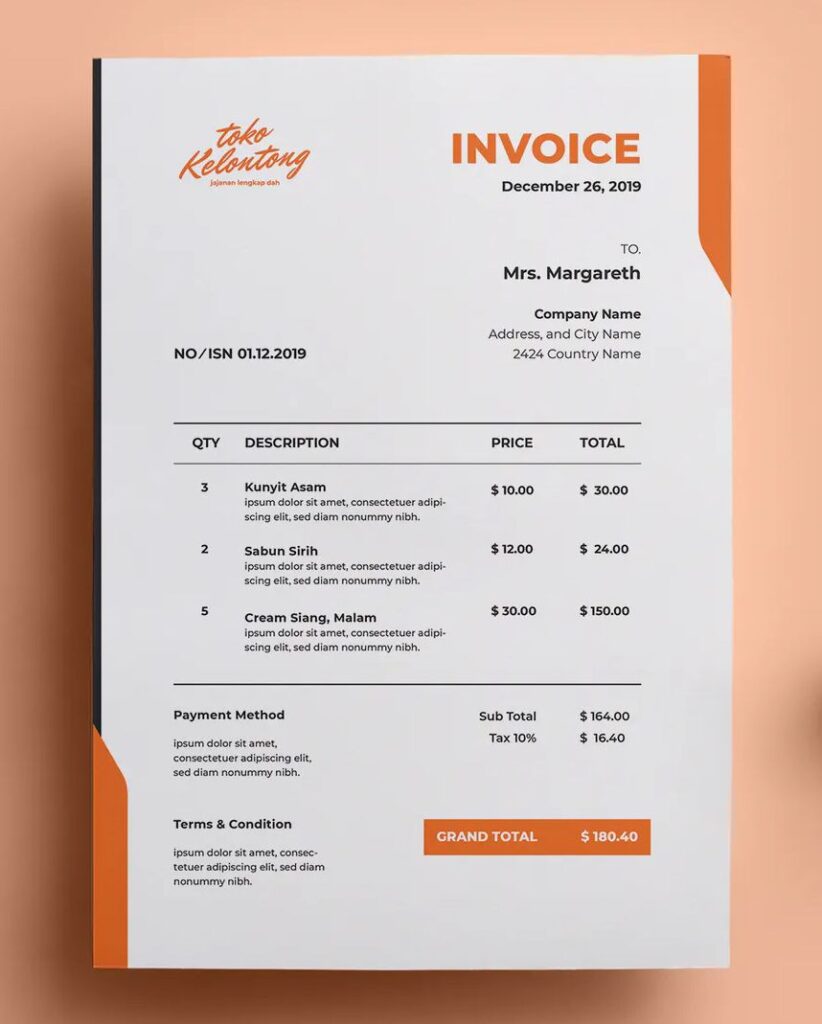

T3 Loan DSA calculate sales employee incentives by multiplying their sales performance by a predefined commission percentage.

Incentive = Sales Performance x Commission Percentage behind every lead.

T3 Loan DSA calculate sales employee incentives by multiplying their sales performance by a predefined commission percentage.

Incentive = Sales Performance x Commission Percentage behind every lead.

Schedule Personalized FREE Demo For You Today!